A) debit to Income Summary for $1,300.

B) credit to Income Summary for $1,300.

C) debit to Income Summary for $7,000.

D) credit to Income Summary for $7,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following depicts the proper sequence of steps in the accounting cycle?

A) Journalize the transactions, analyze business transactions, prepare a trial balance

B) Prepare a trial balance, prepare financial statements, prepare adjusting entries

C) Prepare a trial balance, prepare adjusting entries, prepare financial statements

D) Prepare a trial balance, post to ledger accounts, post adjusting entries

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The amounts appearing on an income statement should agree with the amounts appearing on the post-closing trial balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be classified a long-term liability?

A) Current maturities of long-term debt

B) Bonds payable

C) Mortgage payable

D) Lease liabilities

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most important information needed to determine if companies can pay their current obligations is the

A) net income for this year.

B) projected net income for next year.

C) relationship between current assets and current liabilities.

D) relationship between short-term and long-term liabilities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relationship between current assets and current liabilities is important in evaluating a company's

A) profitability.

B) liquidity.

C) market value.

D) accounting cycle.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The account, Supplies, will appear in the following debit columns of the worksheet.

A) Trial balance

B) Adjusted trial balance

C) Balance sheet

D) All of these answer choices are correct

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following steps in the accounting cycle would not generally be performed daily?

A) Journalize transactions

B) Post to ledger accounts

C) Prepare adjusting entries

D) Analyze business transactions

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

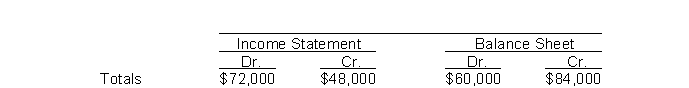

The income statement and balance sheet columns of Iron and Wine Company's worksheet reflect the following totals:  To enter the net income (or loss) for the period into the above worksheet requires an entry to the

To enter the net income (or loss) for the period into the above worksheet requires an entry to the

A) income statement debit column and the balance sheet credit column.

B) income statement credit column and the balance sheet debit column.

C) income statement debit column and the income statement credit column.

D) balance sheet debit column and the balance sheet credit column.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

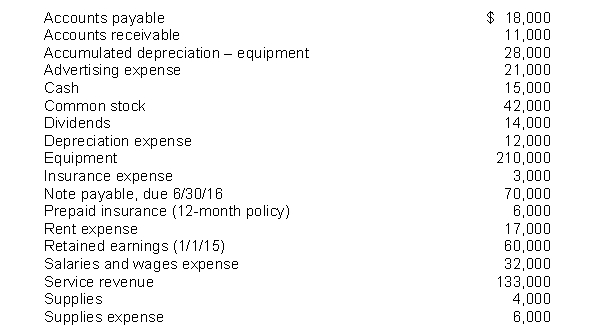

The following items are taken from the financial statements of the Postal Service for the year ending December 31, 2015:  What is the book value of the equipment at December 31, 2015?

What is the book value of the equipment at December 31, 2015?

A) $170,000

B) $182,000

C) $210,000

D) $238,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are property, plant, and equipment except

A) supplies.

B) machinery.

C) land.

D) buildings.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liabilities are generally classified on a balance sheet as

A) small liabilities and large liabilities.

B) present liabilities and future liabilities.

C) tangible liabilities and intangible liabilities.

D) current liabilities and long-term liabilities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under IFRS

A) companies can apply fair value to property, plant, and equipment and natural resources.

B) companies can apply fair value to property, plant, and equipment but not to natural resources.

C) companies can apply fair value to neither property, plant, and equipment nor natural resources.

D) companies can apply fair value to natural resources but not to property, plant, and equipment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Closing entries are

A) an optional step in the accounting cycle.

B) posted to the ledger accounts from the worksheet.

C) made to close permanent or real accounts.

D) journalized in the general journal.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An error has occurred in the closing entry process if

A) revenue and expense accounts have zero balances.

B) the retained earnings account is credited for the amount of net income.

C) the dividends account is closed to the retained earnings account.

D) the balance sheet accounts have zero balances.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When constructing a worksheet, accounts are often needed that are not listed in the trial balance already entered on the worksheet from the ledger. Where should these additional accounts be shown on the worksheet?

A) They should be inserted in alphabetical order into the trial balance accounts already given.

B) They should be inserted in chart of account order into the trial balance already given.

C) They should be inserted on the lines immediately below the trial balance totals.

D) They should not be inserted on the trial balance until the next accounting period.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The dividends account is a permanent account whose balance is carried forward to the next accounting period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the total debit column exceeds the total credit column of the income statement columns on a worksheet, then the company has

A) earned net income for the period.

B) an error because debits do not equal credits.

C) suffered a net loss for the period.

D) to make an adjusting entry.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

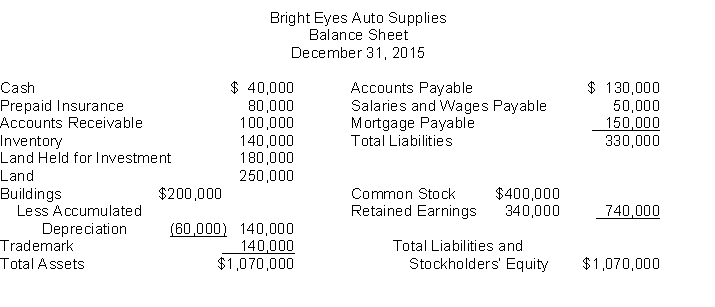

The following information is for Bright Eyes Auto Supplies:  The total dollar amount of assets to be classified as investments is

The total dollar amount of assets to be classified as investments is

A) $0.

B) $140,000.

C) $180,000.

D) $250,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two optional steps in the accounting cycle are preparing

A) a post-closing trial balance and reversing entries.

B) a worksheet and post-closing trial balances.

C) reversing entries and a worksheet.

D) an adjusted trial balance and a post-closing trial balance.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 170

Related Exams