Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 52

Multiple Choice

Carter's preferred stock pays a dividend of $1.00 per quarter.If the price of the stock is $45.00,what is its nominal (not effective) annual rate of return?

A) 8.03%

B) 8.24%

C) 8.45%

D) 8.67%

E) 8.89%

F) A) and E)

G) B) and E)

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Question 53

Multiple Choice

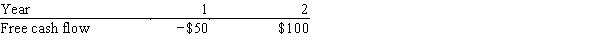

Kale Inc.forecasts the free cash flows (in millions) shown below.If the weighted average cost of capital is 11.0% and FCF is expected to grow at a rate of 5.0% after Year 2,what is the firm's total corporate value,in millions?

A) $1,456

B) $1,529

C) $1,606

D) $1,686

E) $1,770

F) A) and E)

G) C) and D)

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 54

True/False

The constant growth DCF model used to evaluate the prices of common stocks is conceptually similar to the model used to find the price of perpetual preferred stock or other perpetuities.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 55

Multiple Choice

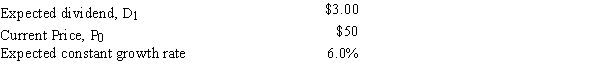

Stock X has the following data.Assuming the stock market is efficient and the stock is in equilibrium,which of the following statements is CORRECT?

A) The stock's required return is 10%.

B) The stock's expected dividend yield and growth rate are equal.

C) The stock's expected dividend yield is 5%.

D) The stock's expected capital gains yield is 5%.

E) The stock's expected price 10 years from now is $100.00.

F) B) and D)

G) B) and C)

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Question 56

True/False

The corporate valuation model can be used only when a company doesn't pay dividends.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 57

True/False

Classified stock differentiates various classes of common stock,and using it is one way companies can meet special needs such as when owners of a start-up firm need additional equity capital but don't want to relinquish voting control.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 58

True/False

If a stock's market price exceeds its intrinsic value as seen by the marginal investor,then the investor will sell the stock until its price has fallen down to the level of the investor's estimate of the intrinsic value.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 59

Multiple Choice

Ryan Enterprises forecasts the free cash flows (in millions) shown below.The weighted average cost of capital is 13.0%,and the FCFs are expected to continue growing at a 5.0% rate after Year 3.What is the firm's total corporate value,in millions?

A) $314.51

B) $331.06

C) $348.48

D) $366.82

E) $386.13

F) A) and B)

G) A) and C)

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 89 of 89

Related Exams