A) Generally, debt ratios do not vary much among different industries, although they do vary among firms within a given industry.

B) Electric utilities generally have very high common equity ratios because their revenues are more volatile than those of firms in most other industries.

C) Airline companies tend to have very volatile earnings, and as a result they generally have high target debt-to-equity ratios.

D) Wide variations in capital structures exist both between industries and among individual firms within given industries. These differences are caused by differing business risks and also managerial attitudes.

E) Since most stocks sell at or very close to their book values, book value capital structures are typically adequate for use in estimating firms' weighted average costs of capital.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

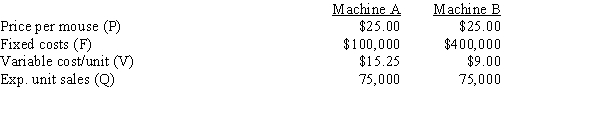

Your company plans to produce a new product,a wireless computer mouse.Two machines can be used to make the mouse,Machines A and B.The price per mouse will be $25.00 regardless of which machine is used.The fixed and variable costs associated with the two machines are shown below.At the expected sales level of 75,000 units,how much higher or lower will the firm's expected EBIT be if it uses Machine B with high fixed costs rather than Machine A with low fixed costs,i.e.,what is EBITB − EBITA?

A) $123,019

B) $136,688

C) $151,875

D) $168,750

E) $185,625

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

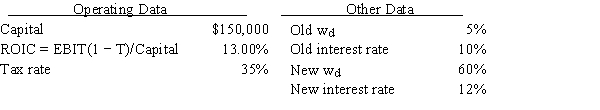

Your firm's debt ratio is only 5.00%,but the new CFO thinks that more debt should be employed.She wants to sell bonds and use the proceeds to buy back and retire common shares so the percentage of common equity in the capital structure (wc) = 1 − wd.Other things held constant,and based on the data below,if the firm increases the percentage of debt in its capital structure (wd) to 60.0%,by how much would the ROE change,i.e.,what is ROENew − ROEOld?

A) 6.73%

B) 7.09%

C) 7.46%

D) 7.83%

E) 8.22%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

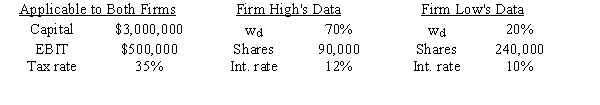

You plan to invest in one of two home delivery pizza companies,High and Low,that were recently founded and are about to commence operations.They are identical except for their use of debt (wd) and the interest rates on their debt⎯High uses more debt and thus must pay a higher interest rate.Based on the data given below,how much higher or lower will High's expected EPS be versus that of Low,i.e.,what is EPSHigh − EPSLow?

A) $0.49

B) $0.54

C) $0.60

D) $0.66

E) $0.73

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Increasing its use of financial leverage is one way to increase a firm's return on investors' capital (ROIC) .

B) If a firm lowered its fixed costs but increased its variable costs by just enough to hold total costs at the present level of sales constant, this would increase its operating leverage.

C) The debt ratio that maximizes expected EPS generally exceeds the debt ratio that maximizes share price.

D) If a company were to issue debt and use the money to repurchase common stock, this would reduce its return on investors' capital (ROIC) . (Assume that the repurchase has no impact on the company's operating income.)

E) If a change in the bankruptcy code made bankruptcy less costly to corporations, this would tend to reduce corporations' debt ratios.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

According to the signaling theory of capital structure,firms first use common equity for their capital,then use debt if and only if they can raise no more equity on "reasonable" terms.This occurs because the use of debt financing signals to investors that the firm's managers think that the future does not look good.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A group of venture investors is considering putting money into Lemma Books,which wants to produce a new reader for electronic books.The variable cost per unit is estimated at $250,the sales price would be set at twice the VC/unit,or $500,and fixed costs are estimated at $750,000.The investors will put up the funds if the project is likely to have an operating income of $500,000 or more.What sales volume would be required in order to meet the minimum profit goal? (Hint: Use the break-even formula,but include the required profit in the numerator.)

A) 4,513

B) 4,750

C) 5,000

D) 5,250

E) 5,513

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

As the text indicates,a firm's financial risk can and should be divided into separate market and diversifiable risk components.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 88 of 88

Related Exams