A) Other things held constant, the higher a firm's days sales outstanding (DSO) , the better its credit department.

B) If a firm that sells on terms of net 30 changes its policy to 2/10, net 30, and if no change in sales volume occurs, then the firm's DSO will probably increase.

C) If a firm sells on terms of 2/10, net 30, and its DSO is 30 days, then the firm probably has some past due accounts.

D) If a firm sells on terms of net 60, and if its sales are highly seasonal, with a sharp peak in December, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July.

E) If a firm changed the credit terms offered to its customers from 2/10, net 30 to 2/10, net 60, then its sales should increase, and this should lead to an increase in sales per day, and that should lead to a decrease in the DSO.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms generally choose to finance temporary current assets with short-term debt because

A) matching the maturities of assets and liabilities reduces risk under some circumstances, and also because short-term debt is often less expensive than long-term capital.

B) short-term interest rates have traditionally been more stable than long-term interest rates.

C) a firm that borrows heavily on a long-term basis is more apt to be unable to repay the debt than a firm that borrows short term.

D) the yield curve is normally downward sloping.

E) short-term debt has a higher cost than equity capital.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zarruk Construction's DSO is 50 days (on a 365-day basis) ,accounts receivable are $100 million,and its balance sheet shows inventory of $125 million.What is the inventory turnover ratio?

A) 4.73

B) 5.26

C) 5.84

D) 6.42

E) 7.07

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Synchronization of cash flows is an important cash management technique,as proper synchronization can reduce the required cash balance and increase a firm's profitability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edison Inc.has annual sales of $36,500,000,or $100,000 a day on a 365-day basis.The firm's cost of goods sold is 75% of sales.On average,the company has $9,000,000 in inventory and $8,000,000 in accounts receivable.The firm is looking for ways to shorten its cash conversion cycle.Its CFO has proposed new policies that would result in a 20% reduction in both average inventories and accounts receivable.She also anticipates that these policies would reduce sales by 10%,while the payables deferral period would remain unchanged at 35 days.What effect would these policies have on the company's cash conversion cycle? Round to the nearest whole day.

A) −26 days

B) −22 days

C) −18 days

D) −14 days

E) −11 days

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement completions is CORRECT? If the yield curve is upward sloping,then the marketable securities held in a firm's portfolio,assumed to be held for emergencies,should

A) consist mainly of long-term securities because they pay higher rates.

B) consist mainly of short-term securities because they pay higher rates.

C) consist mainly of U.S. Treasury securities to minimize interest rate risk.

D) consist mainly of short-term securities to minimize interest rate risk.

E) be balanced between long- and short-term securities to minimize the adverse effects of either an upward or a downward trend in interest rates.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kirk Development buys on terms of 2/15,net 60 days.It does not take discounts,and it typically pays on time,60 days after the invoice date.Net purchases amount to $550,000 per year.On average,what is the dollar amount of total trade credit (costly + free) the firm receives during the year,i.e.,what are its average accounts payable? (Assume a 365-day year,and note that purchases are net of discounts.)

A) $ 90,411

B) $ 94,932

C) $ 99,678

D) $104,662

E) $109,895

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Affleck Inc.'s business is booming,and it needs to raise more capital.The company purchases supplies on terms of 1/10,net 20,and it currently takes the discount.One way of acquiring the needed funds would be to forgo the discount,and the firm's owner believes she could delay payment to 40 days without adverse effects.What would be the effective annual percentage cost of funds raised by this action? (Assume a 365-day year.)

A) 10.59%

B) 11.15%

C) 11.74%

D) 12.36%

E) 13.01%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Margetis Inc.carries an average inventory of $750,000.Its annual sales are $10 million,its cost of goods sold is 75% of annual sales,and its receivables collection period is twice as long as its inventory conversion period.The firm buys on terms of net 30 days,and it pays on time.Its new CFO wants to decrease the cash conversion cycle by 10 days,based on a 365-day year.He believes he can reduce the average inventory to $647,260 with no effect on sales.By how much must the firm also reduce its accounts receivable to meet its goal in the reduction of its cash conversion cycle?

A) $123,630

B) $130,137

C) $136,986

D) $143,836

E) $151,027

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The calculated cost of trade credit for a firm that buys on terms of 2/10,net 30,is lower (other things held constant)if the firm plans to pay in 40 days than in 30 days.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's suppliers stop offering discounts,then its use of trade credit is more likely to increase than to decrease other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a profitable firm finds that it simply must "stretch" its accounts payable,then this suggests that it is undercapitalized,i.e.,that it needs more working capital to support its operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

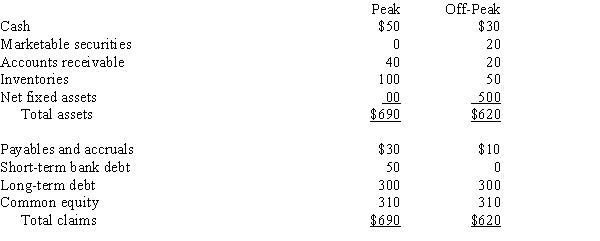

Swim Suits Unlimited is in a highly seasonal business,and the following summary balance sheet data show its assets and liabilities at peak and off-peak seasons (in thousands of dollars) :

From this data we may conclude that

A) Swim Suits' current asset financing policy calls for exactly matching asset and liability maturities.

B) Swim Suits' current asset financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt.

C) Swim Suits follows a relatively conservative approach to current asset financing; that is, some of its short-term needs are met by permanent capital.

D) Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

E) Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Depreciation is included in the estimate of free cash flows (FCF = EBIT(1 − T) + Depreciation − [Capital expenditures + ΔNOWC]) , hence depreciation is set forth on a separate line in the cash budget.

B) If cash inflows from collections occur in equal daily amounts but most payments must be made on the 10th of each month, then a regular monthly cash budget will be misleading. The problem can be corrected by using a daily cash budget.

C) Sound working capital policy is designed to maximize the time between cash expenditures on materials and the collection of cash on sales.

D) If a firm wants to generate more cash flow from operations in the next month or two, it could change its credit policy from 2/10, net 30 to net 60.

E) If a firm sells on terms of net 90, and if its sales are highly seasonal, with 80% of its sales in September, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in October than in August.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Accruals arise automatically from a firm's operations and are "free" capital in the sense that no explicit interest must normally be paid on accrued liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 16.1 Zorn Corporation is deciding whether to pursue a restricted or relaxed working capital investment policy. The firm's annual sales are expected to total $3,600,000, its fixed assets turnover ratio equals 4.0, and its debt and common equity are each 50% of total assets. EBIT is $150,000, the interest rate on the firm's debt is 10%, and the tax rate is 40%. If the company follows a restricted policy, its total assets turnover will be 2.5. Under a relaxed policy its total assets turnover will be 2.2. -Refer to Exhibit 16.1.What's the difference in the projected ROEs under the restricted and relaxed policies?

A) 1.20%

B) 1.50%

C) 1.80%

D) 2.16%

E) 2.59%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edwards Enterprises follows a moderate current asset investment policy,but it is now considering a change,perhaps to a restricted or maybe to a relaxed policy.The firm's annual sales are $400,000; its fixed assets are $100,000; its target capital structure calls for 50% debt and 50% equity; its EBIT is $35,000; the interest rate on its debt is 10%; and its tax rate is 40%.With a restricted policy,current assets will be 15% of sales,while under a relaxed policy they will be 25% of sales.What is the difference in the projected ROEs between the restricted and relaxed policies.

A) 4.25%

B) 4.73%

C) 5.25%

D) 5.78%

E) 6.35%

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The relative profitability of a firm that employs an aggressive working capital financing policy will improve if the yield curve changes from upward sloping to downward sloping.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

On average,a firm collects checks totaling $250,000 per day.It takes the firm approximately 4 days from the day the checks were mailed until they result in usable cash for the firm.Assume that (1)a lockbox system could be employed which would reduce the cash conversion procedure to 2 1/2 days and (2)the firm could invest any additional cash generated at 6% after taxes.The lockbox system would be a good buy if it costs $25,000 annually.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Van Den Borsh Corp.has annual sales of $50,735,000,an average inventory level of $15,012,000,and average accounts receivable of $10,008,000.The firm's cost of goods sold is 85% of sales.The company makes all purchases on credit and has always paid on the 30th day.However,it now plans to take full advantage of trade credit and to pay its suppliers on the 40th day.The CFO also believes that sales can be maintained at the existing level but inventory can be lowered by $1,946,000 and accounts receivable by $1,946,000.What will be the net change in the cash conversion cycle,assuming a 365-day year?

A) −26.6 days

B) −29.5 days

C) −32.8 days

D) −36.4 days

E) −40.5 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 126

Related Exams