A) 5.8% B

B) 8.7%

C) 9.5%

D) 10.25%

E) 14.25%

G) None of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The slope of an asset's security market line is the:

A) reward-to-risk ratio.

B) portfolio weight.

C) beta coefficient.

D) risk-free interest rate.

E) market risk premium.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beta measures:

A) the ability to diversify risk.

B) how an asset covaries with the market.

C) the actual return on an asset.

D) the standard deviation of the assets' returns.

E) All of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk-free rate of return is 4% and the market risk premium is 8%.What is the expected rate of return on a stock with a beta of 1.28?

A) 9.12%

B) 10.24%

C) 13.12%

D) 14.24%

E) 15.36%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would indicate a portfolio is being effectively diversified?

A) an increase in the portfolio beta

B) a decrease in the portfolio beta

C) an increase in the portfolio rate of return

D) an increase in the portfolio standard deviation

E) a decrease in the portfolio standard deviation

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zelo,Inc.stock has a beta of 1.23.The risk-free rate of return is 4.5% and the market rate of return is 10%.What is the amount of the risk premium on Zelo stock?

A) 4.47%

B) 5.50%

C) 5.54%

D) 6.77%

E) 12.30%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of portfolio diversification is to:

A) increase returns and risks.

B) eliminate all risks.

C) eliminate asset-specific risk.

D) eliminate systematic risk.

E) lower both returns and risks.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an example of a nondiversifiable risk?

A) a well-respected president of a firm suddenly resigns

B) a well-respected chairman of the Federal Reserve suddenly resigns

C) a key employee suddenly resigns and accepts employment with a key competitor

D) a well-managed firm reduces its work force and automates several jobs

E) a poorly managed firm suddenly goes out of business due to lack of sales

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct concerning the expected rate of return on an individual stock given various states of the economy?

A) The expected return is a geometric average where the probabilities of the economic states are used as the exponential powers.

B) The expected return is an arithmetic average of the individual returns for each state of the economy.

C) The expected return is a weighted average where the probabilities of the economic states are used as the weights.

D) The expected return is equal to the summation of the values computed by dividing the expected return for each economic state by the probability of the state.

E) As long as the total probabilities of the economic states equal 100%,then the expected return on the stock is a geometric average of the expected returns for each economic state.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The systematic risk of the market is measured by:

A) a beta of 1.0.

B) a beta of 0.0.

C) a standard deviation of 1.0.

D) a standard deviation of 0.0.

E) a variance of 1.0.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a stock portfolio is well diversified,then the portfolio variance:

A) will equal the variance of the most volatile stock in the portfolio.

B) may be less than the variance of the least risky stock in the portfolio.

C) must be equal to or greater than the variance of the least risky stock in the portfolio.

D) will be a weighted average of the variances of the individual securities in the portfolio.

E) will be an arithmetic average of the variances of the individual securities in the portfolio.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the CAPM:

A) the expected return on a security is negatively and non-linearly related to the security's beta.

B) the expected return on a security is negatively and linearly related to the security's beta.

C) the expected return on a security is positively and linearly related to the security's variance.

D) the expected return on a security is positively and non-linearly related to the security's beta.

E) the expected return on a security is positively related to the security's beta.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your portfolio is comprised of 30% of stock X,50% of stock Y,and 20% of stock Z.Stock X has a beta of .64,stock Y has a beta of 1.48,and stock Z has a beta of 1.04.What is the beta of your portfolio?

A) 1.01

B) 1.05

C) 1.09

D) 1.14

E) 1.18

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The correlation between two stocks:

A) can take on positive values.

B) can take on negative values.

C) cannot be greater than 1.

D) cannot be less than -1.

E) All of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a security is added to a portfolio the appropriate return and risk contributions are:

A) the expected return of the asset and its standard deviation.

B) the expected return and the variance.

C) the expected return and the beta.

D) the historical return and the beta.

E) these both cannot be measured.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

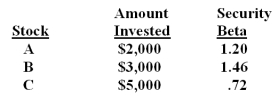

What is the beta of a portfolio comprised of the following securities?

A) 1.008

B) 1.014

C) 1.038

D) 1.067

E) 1.127

G) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

In the first chapter,it was stated that financial managers should act to maximize shareholder wealth.Why are the efficient markets hypothesis (EMH),the CAPM,and the SML so important in the accomplishment of this objective?

Correct Answer

verified

In simple terms,one could say that maximizing shareholder wealth by maximizing the current share price is a reasonable objective if and only if we have some assurance that observed prices are meaningful;i.e. ,that they reflect the value of the firm.This is a major implication of the EMH.Further,if we are to be able to assess the wealth effects of future decisions on security and firm values,we must have a valuation model whose parameters can be shown to be affected by those decisions.Finally,any valuation model we employ will require us to quantify return and risk.

Correct Answer

verified

Multiple Choice

The dominant portfolio with the lowest possible risk is:

A) the efficient frontier.

B) the minimum variance portfolio.

C) the upper tail of the efficient set.

D) the tangency portfolio.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As we add more securities to a portfolio,the ____ will decrease:

A) total risk.

B) systematic risk.

C) unsystematic risk.

D) economic risk.

E) standard error.

G) D) and E)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A stock with an actual return that lies above the security market line:

A) has more systematic risk than the overall market.

B) has more risk than warranted based on the realized rate of return.

C) has yielded a higher return than expected for the level of risk assumed.

D) has less systematic risk than the overall market.

E) has yielded a return equivalent to the level of risk assumed.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 125

Related Exams