A) 46.71%

B) 60.97%

C) 36.88%

D) 44.26%

E) 49.17%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose a firm that has been earning $2 and paying a dividend of $1.00,or a 50% dividend payout,announces that it is increasing the dividend to $1.50.The stock price then jumps from $20 to $30.Some people would argue that this is proof that investors prefer dividends to retained earnings.Miller and Modigliani would agree with this argument.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the information content,or signaling,hypothesis is correct,then a change in a firm's dividend policy can have an important effect on its stock price and cost of equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions will best enable a company to raise additional equity capital,other things held constant?

A) Refund long-term debt with lower cost short-term debt.

B) Declare a stock split.

C) Begin an open-market purchase dividend reinvestment plan.

D) Initiate a stock repurchase program.

E) Begin a new-stock dividend reinvestment plan.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The optimal distribution policy strikes that balance between current dividends and capital gains that maximizes the firm's stock price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pavlin Corp.'s projected capital budget is $2,000,000,its target capital structure is 40% debt and 60% equity,and its forecasted net income is $1,150,000.If the company follows the residual dividend model,how much dividends will it pay or,alternatively,how much new stock must it issue?

A) $00;$50,000

B) $42,500;$39,500

C) $52,500;$50,500

D) $40,500;$48,500

E) $52,500;$56,000

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grullon Co.is considering a 7-for-3 stock split.The current stock price is $97.50 per share,and the firm believes that its total market value would increase by 7% as a result of the improved liquidity that should follow the split.What is the stock's expected price following the split?

A) $42.92

B) $53.65

C) $49.63

D) $44.71

E) $38.00

G) A) and D)

Correct Answer

verified

Correct Answer

verified

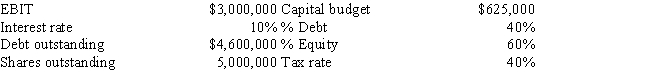

Multiple Choice

NY Fashions has the following data.If it follows the residual dividend model,how much total dividends,if any,will it pay out?

A) $231,000

B) $258,500

C) $291,500

D) $335,500

E) $275,000

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Some investors prefer dividends to retained earnings (and the capital gains retained earnings bring),while others prefer retained earnings to dividends.Other things held constant,it makes sense for a company to establish its dividend policy and stick to it,and then it will attract a clientele of investors who like that policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dentaltech Inc.projects the following data for the coming year.If the firm follows the residual dividend model and also maintains its target capital structure,what will its dividend payout ratio be?

A) 75.4%

B) 86.7%

C) 58.8%

D) 88.2%

E) 89.0%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If on January 3 a company declares a dividend of $1.50 per share,payable on January 31 then the price of the stock should drop by approximately $1.50 on January 31.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The announcement of an increase in the cash dividend should,according to MM,lead to an increase in the price of the firm's stock,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Underlying the dividend irrelevance theory proposed by Miller and Modigliani is their argument that the value of the firm is determined only by its basic earning power and its business risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fauver Industries plans to have a capital budget of $600,000.It wants to maintain a target capital structure of 40% debt and 60% equity,and it also wants to pay a dividend of $300,000.If the company follows the residual dividend model,how much net income must it earn to meet its investment requirements,pay the dividend,and keep the capital structure in balance?

A) $660,000

B) $514,800

C) $600,600

D) $712,800

E) $580,800

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Toombs Media Corp.recently completed a 3-for-1 stock split.Prior to the split,its stock sold for $170 per share.The firm's total market value was unchanged by the split.Other things held constant,what is the best estimate of the stock's post-split price?

A) $57.23

B) $65.73

C) $64.60

D) $63.47

E) $56.67

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 75 of 75

Related Exams