A) $02.48

B) $02.35

C) $03.10

D) $02.85

E) $02.60

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

According to Modigliani and Miller (MM),in a world with corporate income taxes the optimal capital structure calls for approximately 100% debt financing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A group of venture investors is considering putting money into Lemma Books,which wants to produce a new reader for electronic books.The variable cost per unit is estimated at $250,the sales price would be set at twice the VC/unit,or $500,and fixed costs are estimated at $350,000.The investors will put up the funds if the project is likely to have an operating income of $500,000 or more.What sales volume would be required in order to meet the minimum profit goal? (Hint: Use the break-even formula,but include the required profit in the numerator. )

A) 3,706

B) 3,400

C) 2,958

D) 3,094

E) 4,216

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following events would be most likely to encourage a firm to increase the amount of debt in its capital structure?

A) Its sales are projected to become less stable in the future.

B) The bankruptcy laws are changed in a way that would make bankruptcy more costly to the firm and its stockholders.

C) Management believes that the firm's stock is currently overvalued.

D) The firm decides to automate its factory with specialized equipment and thus increase its use of operating leverage.

E) The corporate tax rate is increased.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

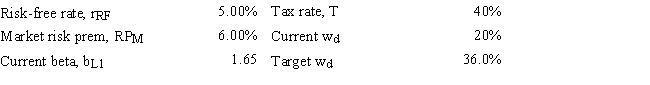

Dyson Inc.currently finances with 20.0% debt (i.e. ,wd = 20%) ,but its new CFO is considering changing the capital structure so wd = 36.0% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1 - wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity? Do not round your intermediate calculations.(Hint: You must unlever the current beta and then use the unlevered beta to solve the problem. )

A) 1.61%

B) 1.66%

C) 1.24%

D) 1.68%

E) 1.69%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's capital structure does not affect its free cash flows as discussed in the text,because FCF reflects only operating cash flows,which are available to service debt,to pay dividends to stockholders,and for other purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southwest U's campus book store sells course packs for $18 each,the variable cost per pack is $8,fixed costs to produce the packs are $200,000,and expected annual sales are 51,000 packs.What are the pre-tax profits from sales of course packs?

A) $285,200

B) $310,000

C) $306,900

D) $248,000

E) $372,000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A firm can use retained earnings without paying a flotation cost.Therefore,while the cost of retained earnings is not zero,its cost is generally lower than the after-tax cost of debt.

B) The capital structure that minimizes a firm's weighted average cost of capital is also the capital structure that maximizes its stock price.

C) The capital structure that minimizes the firm's weighted average cost of capital is also the capital structure that maximizes its earnings per share.

D) If a firm finds that the cost of debt is less than the cost of equity,increasing its debt ratio must reduce its WACC.

E) Other things held constant,if corporate tax rates declined,then the Modigliani-Miller tax-adjusted theory would suggest that firms should increase their use of debt.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 88 of 88

Related Exams