A) 2.16 years

B) 2.28 years

C) 2.02 years

D) 2.12 years

E) 2.00 years

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

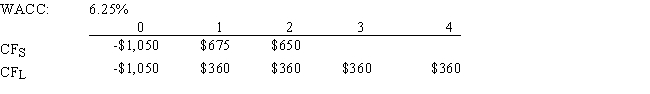

Kosovski Company is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and are not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

A) $29.26

B) $23.11

C) $32.18

D) $32.77

E) $25.45

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The NPV method assumes that cash flows will be reinvested at the WACC,while the IRR method assumes reinvestment at the IRR.

B) The NPV method assumes that cash flows will be reinvested at the risk-free rate,while the IRR method assumes reinvestment at the IRR.

C) The NPV method assumes that cash flows will be reinvested at the WACC,while the IRR method assumes reinvestment at the risk-free rate.

D) The NPV method does not consider all relevant cash flows,particularly cash flows beyond the payback period.

E) The IRR method does not consider all relevant cash flows,particularly cash flows beyond the payback period.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

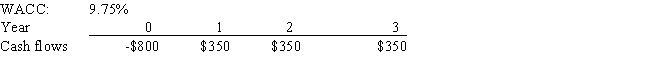

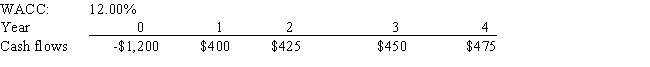

Ingram Electric Products is considering a project that has the following cash flow and WACC data.What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 11.48%

B) 10.57%

C) 13.05%

D) 15.00%

E) 14.35%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The NPV method is based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The regular payback method is deficient in that it does not take account of cash flows beyond the payback period.The discounted payback method corrects this fault.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows,with one outflow followed by a series of inflows.

A) If Project A has a higher IRR than Project B,then Project A must have the lower NPV.

B) If Project A has a higher IRR than Project B,then Project A must also have a higher NPV.

C) The IRR calculation implicitly assumes that all cash flows are reinvested at the WACC.

D) The IRR calculation implicitly assumes that cash flows are withdrawn from the business rather than being reinvested in the business.

E) If a project has normal cash flows and its IRR exceeds its WACC,then the project's NPV must be positive.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

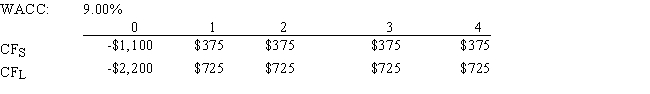

Nast Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV,how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

A) $34.24

B) $26.78

C) $33.90

D) $27.80

E) $25.77

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The internal rate of return is that discount rate that equates the present value of the cash outflows (or costs)with the present value of the cash inflows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One defect of the IRR method versus the NPV is that the IRR does not take account of cash flows over a project's full life.

B) One defect of the IRR method versus the NPV is that the IRR does not take account of the time value of money.

C) One defect of the IRR method versus the NPV is that the IRR does not take account of the cost of capital.

D) One defect of the IRR method versus the NPV is that the IRR values a dollar received today the same as a dollar that will not be received until sometime in the future.

E) One defect of the IRR method versus the NPV is that the IRR does not take proper account of differences in the sizes of projects.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A conflict will exist between the NPV and IRR methods,when used to evaluate two equally risky but mutually exclusive projects,if the projects' cost of capital is less than the rate at which the projects' NPV profiles cross.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Small businesses make less use of DCF capital budgeting techniques than large businesses.This may reflect a lack of knowledge on the part of small firms' managers,but it may also reflect a rational conclusion that the costs of using DCF analysis outweigh the benefits of these methods for very small firms.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The NPV and IRR methods,when used to evaluate two equally risky but mutually exclusive projects,will lead to different accept/reject decisions and thus capital budgets if the cost of capital at which the projects' NPV profiles cross is greater than the crossover rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

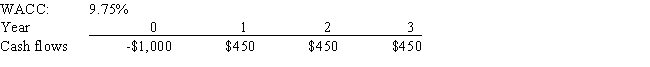

Ehrmann Data Systems is considering a project that has the following cash flow and WACC data.What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 14.11%

B) 15.52%

C) 15.81%

D) 10.72%

E) 17.22%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The shorter a project's payback period,the less desirable the project is normally considered to be by this criterion.

B) One drawback of the payback criterion is that this method does not take account of cash flows beyond the payback period.

C) If a project's payback is positive,then the project should be accepted because it must have a positive NPV.

D) The regular payback ignores cash flows beyond the payback period,but the discounted payback method overcomes this problem.

E) One drawback of the discounted payback is that this method does not consider the time value of money,while the regular payback overcomes this drawback.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Westchester Corp.is considering two equally risky,mutually exclusive projects,both of which have normal cash flows.Project A has an IRR of 11%,while Project B's IRR is 14%.When the WACC is 8%,the projects have the same NPV.Given this information,which of the following statements is CORRECT?

A) If the WACC is 13%,Project A's NPV will be higher than Project B's.

B) If the WACC is 9%,Project A's NPV will be higher than Project B's.

C) If the WACC is 6%,Project B's NPV will be higher than Project A's.

D) If the WACC is greater than 14%,Project A's IRR will exceed Project B's.

E) If the WACC is 9%,Project B's NPV will be higher than Project A's.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A basic rule in capital budgeting is that if a project's NPV exceeds its IRR,then the project should be accepted.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows,with one outflow followed by a series of inflows.

A) A project's NPV is found by compounding the cash inflows at the IRR to find the terminal value (TV) ,then discounting the TV at the WACC.

B) The lower the WACC used to calculate it,the lower the calculated NPV will be.

C) If a project's NPV is less than zero,then its IRR must be less than the WACC.

D) If a project's NPV is greater than zero,then its IRR must be less than zero.

E) The NPV of a relatively low-risk project should be found using a relatively high WACC.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jazz World Inc.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that a project's projected NPV can be negative,in which case it will be rejected.

A) $119.30

B) $118.12

C) $113.40

D) $121.67

E) $135.84

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The MIRR and NPV decision criteria can never conflict.

B) The IRR method can never be subject to the multiple IRR problem,while the MIRR method can be.

C) One reason some people prefer the MIRR to the regular IRR is that the MIRR is based on a generally more reasonable reinvestment rate assumption.

D) The higher the WACC,the shorter the discounted payback period.

E) The MIRR method assumes that cash flows are reinvested at the crossover rate.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 107

Related Exams